Last year was a difficult year for share and bond markets. Markets were negatively impacted by Reserve Banks across the world sharply increasing interest rates to combat inflation. There was also the negative impact of the Ukraine war (on oil and food prices) and continuing supply issues. The S&P500 Index in the US was down more than 18%.

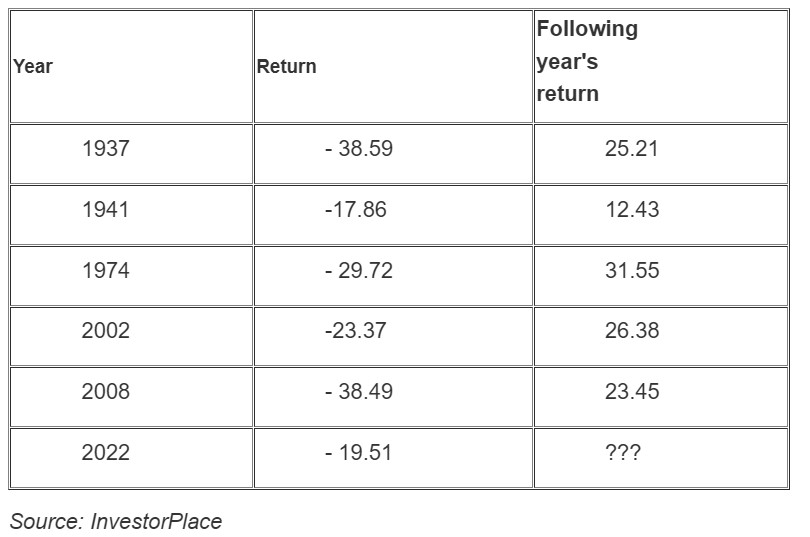

We often emphasise that past performance may not necessarily predict future performance. However, it’s interesting to note that where the S&P500 has been down more than 18%, the following year 20% plus returns have occurred. Every single time for the past 90 years.

Will it be different this time?

In order for a trade to occur on a share market there has to be a willing seller and a willing buyer. Two opposing views. Share markets often tend to move up 6-7 months before we see improvements in earnings, GDP and employment.

In October 2022 we may have seen share markets bottom out.

Monik Kotecha, CEO of Insync Funds Management gives the following reasons why standing on the side-lines may pose a bigger risk than investing this year:

- The US midterm elections were held in November 2022. Historically, the S&P500 has outperformed the market in the 12-month period after a US mid-term election with an average return of 16.3%. It has not delivered a negative return during this period over the last 60 years.

- The current spike in inflation was triggered by the pandemic and supply shortages. The factors triggering inflation in 2022/23 are quite different to the high inflation years of the 1970’s which were triggered by oil prices increasing four fold. Insync believes inflation is transitory and continuing improvements in technology and innovation are major deflationary factors.

Inflation in the US peaked at 9.1% in June and is currently 6.5%. In New Zealand it also looks like inflation may have peaked. However, the floods in Auckland and the Hawkes Bay and the removal of the fuel subsidies at the end of June could have a negative impact on the New Zealand economy.

The experience in Christchurch, following the major earthquake in 2011 was that there was a lift to the New Zealand economy with rebuilds and insurance payouts. Insurance companies shift a lot of their liability off-shore to reinsurers. The NZ Reserve Bank estimates the Canterbury earthquake resulted in disaster costs of around $38 billion of which 72% was funded by reinsurance from overseas.

This can mean insurance payouts is new money into New Zealand resulting in a lift to the economy.