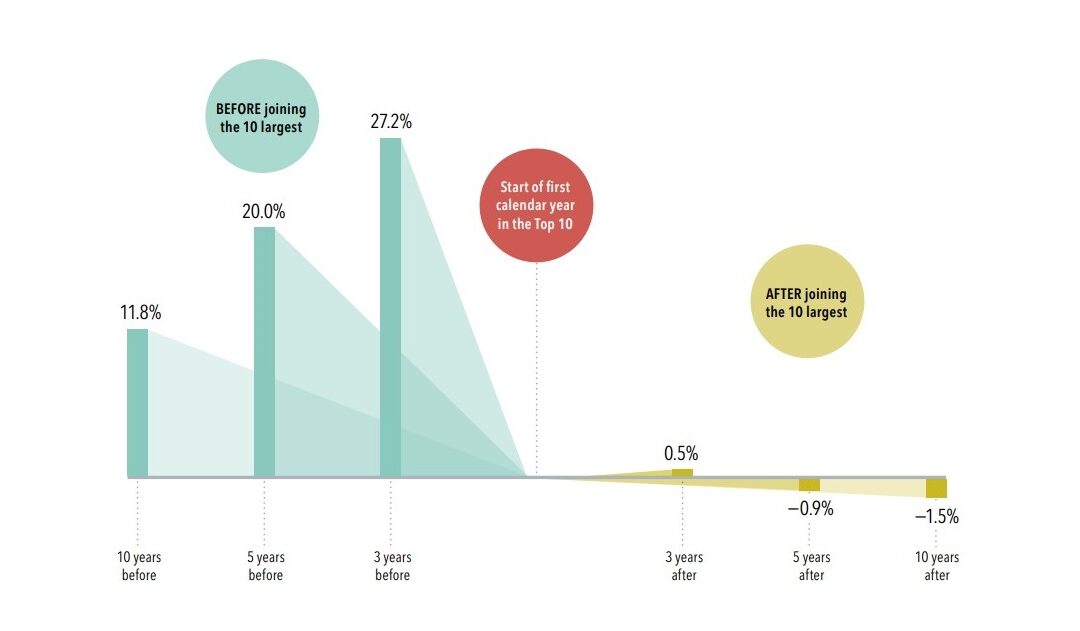

The chart shows the average annualised outperformance of companies before and after they entered the Top 10 shares on the US share market.

The ‘Magnificent Seven’ refers to the high performing tech shares Alphabet (formerly Google), Amazon, Apple, Meta Platforms (formerly Facebook), Microsoft, NVIDIA and Tesla. Its interesting that once the Top 10 largest shares by capitalisation enter the Top 10 on average their performance lags the overall share market performance.

From 1927 to 2023 (Farma/French Total US Market Research Index, 1927-2023) the average annualised return for the Top 10 shares over the three years prior to joining the Top 10 was more than 25% higher than the average share market return.

Five years after joining the Top 10 these shares were on average underperforming the average share market return. The difference was even higher after 10 years.

A share price reflects a company’s prospects. Positive news is likely to push the share price up, but this is not predictable.

Disclaimer: Past performance is no guarantee of future returns.