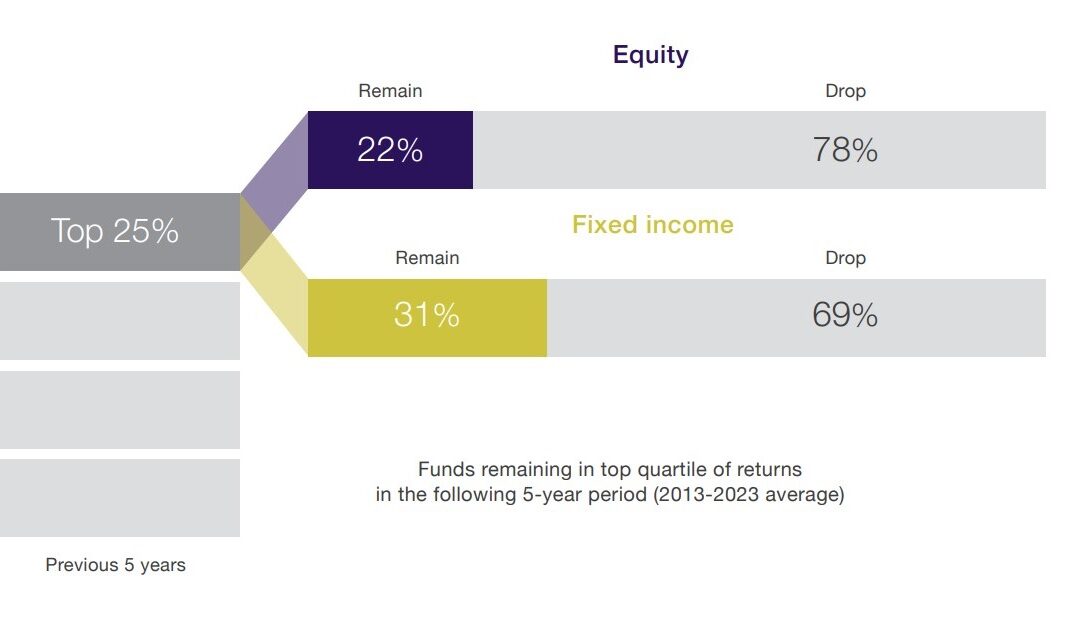

The chart shows the percentage of top-ranked funds that remained on top after 5 years. You might think that selecting investments based on past performance might continue to deliver the best performance.

Research shows that most funds ranked in the top 25% based on five year returns do not remain in the top 25% in the next five years. Only about one in five equity funds stayed in the top 25%.

In addition to this Morningstar Research in their ‘Mind the Gap 2024’ report demonstrated that investors often do not receive the average performance because of trying to time purchases and selling funds at the wrong times. In the report Morningstar found that an investor in a average US managed fund and ETF (Exchange Traded Fund) earned 6.3% over 10 years ending 31 Dec 2023. This was 1.1% less than the average fund’s total return over the same period.

Trying to time the markets by selling when markets fall and buying back in when its ‘safer’ is code for ‘losing money’.

We have looked at this in previous blogs:

Staying the course versus timing the markets

Time in the markets versus timing the markets

Missing the best performing days

The SPIVA score card – Index versus Active Managers