Long-term investing versus speculative investing is very much about having patience and riding out the highs and lows and not missing the best performing days. In our previous article on time in the markets versus timing the markets we looked at the S&P500 index over a 30 year period.

Staying invested and focused on the long term helps to ensure that you are in a position to capture what the market has to offer.

There is no proven way to time the markets – targeting the best days or moving to the sidelines to avoid the worst. History argues for staying put through both the good and bad times is the best option.

The impact of missing just a few of the market’s best days can be profound. We look at a hypothetical investment in shares in both the US and Australian share markets.

Missing the best days in the S&P/ASX300 Index over a 22 year period

-

- A hypothetical $1,000 invested in 2000 turns into $4,932 over the 22 year period ending 30 June 2022.

-

- If you missed the best week over this period the value shrinks to $4,328.

-

- Miss the best 3 months and the return falls to $3,742.

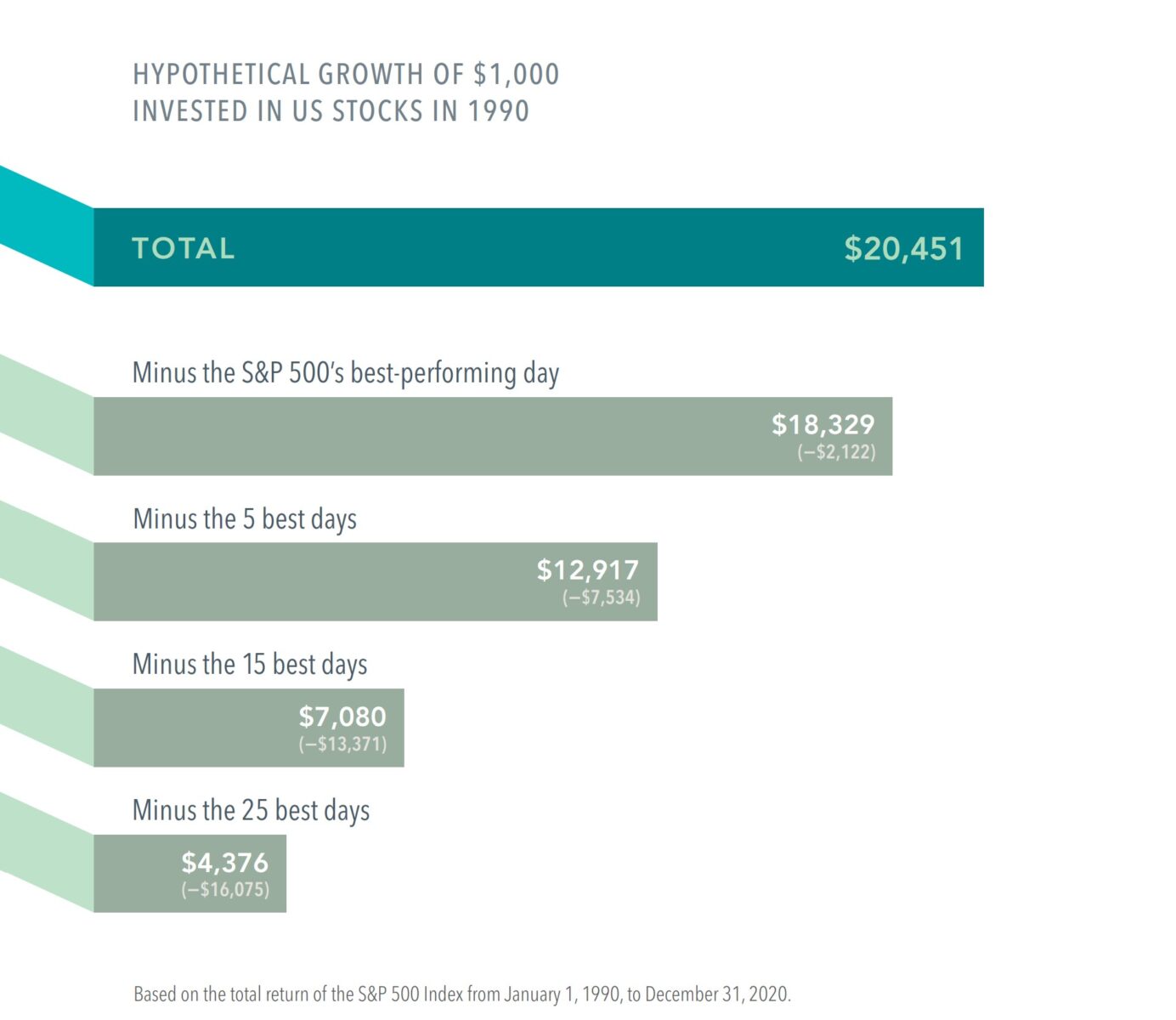

Missing the best days in the S&P500 over a 30 year period

-

- A hypothetical $1,000 turns into $20,451 from 1990 through 2020.

-

- Miss the S&P 500’s five best days and the return dwindles to $12,917.

-

- Miss the 25 best days and that’s $4,376.

Missing only a few days of strong returns can drastically impact the overall performance. The chart below published by JP Morgan illustrates what happens (looking at the S&P500 Index) when an investor missed the 10 single best days in markets over the past 20 years. If missing the 10 best days sounds implausible to you, consider that in the past 20 years, seven of those best days happened within just about two weeks of the 10 worst days.

Are active managers any better at timing the markets?

A study by Dimensional Fund Advisors on the performance of actively managed mutual funds found that even professional investors have difficulty beating the markets. Over the 20 year period ending July 2019 Dimensional found 77% of equity funds and 92% of fixed income funds failed to survive and outperform their benchmarks after costs.

For investors to have a shot at successfully timing the market, they must make the call to buy or sell shares correctly not just once, but twice.