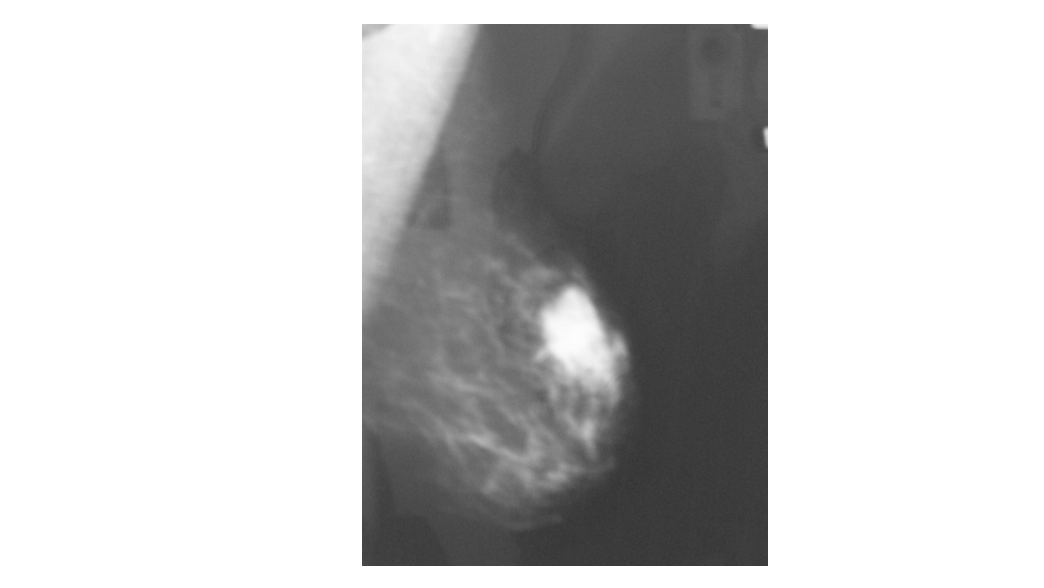

Alison Renfrew was diagnosed with breast cancer on 5th December 2006. The image above is the X-ray, the tumour is the white blob. Doctors refer to this as a ‘back-of-the-room diagnosis’ as it is so distinct.

A biopsy was performed on 6th December with pathology results reported on 8th December identifying the cancer as Grade III, invasive cancer. Her tumour was 3cm.

Alison had a mastectomy on the 13th December 2006 removing her left breast and lymph nodes.

Pathology after the operation confirmed Grade III invasive cancer, Stage I (borderline Stage II), oestrogen and progesterone positive, no lymph node involvement, HER 2-neu negative.

Chemo therapy was recommended (6 courses, 3 week cycles lasting four and half months) and this started on the 26th January 2007.

Facts about breast cancer:

In New Zealand 1 in 9 women get breast cancer in their lifetime. This is the second highest rate in the world.

Alison’s story:

– how she coped with the shocking, out of the blue news.

– her passion for insurance.

Written 4 January 2007

“I have been selling insurance for the last 23 years and talked about the risks but never dreamed it would happen to me.”

You never know what surprises are in store for us. From the time of my diagnosis, which was the 5th December 2006, we went through the depths of despair contemplating selling the business and generally what will happen if I die.

On the 8th December I was informed that my biopsy showed that I had a large invasive and aggressive cancer.

I learned a lot about cancer over the next two weeks. I had a mastectomy on 13th December. Isn’t that an incredibly short time to have had a diagnosis, biopsy and Mastectomy and Auxiliary Dissection (total lymph node removal)? Seems a little surreal.

Richard discovered via a Google search that my sort of cancer, Grade III, gave me a life expectancy of 50% after five years reducing to 45% after 7 years – meaning it can come back to haunt you. That was a very depressing week – very deep emotionally, of course – but my goodness how those bonds of love strengthened. Family and friends were incredibly concerned.

Some web sites we found informative and supportive were Breast Cancer Aotearoa and Breast Cancer UK

During that weekend we started to challenge the statistics. Really, they were just too vague. How many of those aggressive cancers were treated? How many had chemotherapy to wipe out microscopic traces of cancer elsewhere in the body?

We were starting to feel more positive. The surgeon warned us that because of the size of the tumour and the aggressive nature of the cancer I would probably have it in my lymph nodes and the question was how many, as this would be a reflection of how serious it was.

The operation was on the Wednesday 13th December 2006, 9 days after diagnosis, and on the following Friday a pathology report found there was no cancer in the lymph nodes.

The surgeon pre-op had said that based on the size and grade that there was a 75% chance of lymph node involvement. Lymph node involvement means its started to travel) …. Wow! It felt as though a death sentence had been lifted and I felt blessed.

We felt very positive on receiving the post operation pathology report. Maybe the cancer was removed just in time, before it started to travel around the body. We were advised that cancer can travel via the blood vessels, not just the lymph system. While this was a concern it was not nearly as much as we had before.

The chemotherapy is supposed to ‘sweep up’ all the microscopic cancer cells that might be lurking in my body.

I was not looking forward to the chemotherapy. I had read about one woman’s experience where she was so sick that the oncologist stopped her treatment. Later she told the oncologist that she thought she was dying and he said that if she had had another dose of chemo she would have died. He explained that his job is to give as much as possible without killing the patient. Now how reassuring is that for the next six months of my life?

I’m hoping I won’t react so badly to the poison and that I will be able to lead a relatively routine sort of life. Look at the bright side: I won’t need to shave my legs or armpits….and……a Brazilian that will last for six months! right now I don’t need to wear a bra – I’ve never liked wearing bras and am not that keen on getting a ‘falsey’ but I might change my mind later.

I’ll give my body the rest of the year to settle down and at the end of the year I will have breast reconstruction. This is major surgery taking about 6 to 7 hours. My operation mastectomy operation took 89 minutes. The surgeons fee alone was $2,800 plus GST (all up cost $9,600). At this time I reckon I should throw in liposuction for the inner thighs as well. In for a penny, in for a pound.

To me this surgery will represent the closing of an interesting experience in my life which I hope never raises it’s ugly head again, but you never know. You never have an ‘all clear’ with breast cancer as you do with other sorts of cancers.

The first thing I did after my diagnosis was to check how much trauma insurance I had. Guess what? It’s not nearly enough! In a way I might be lucky. If I had suffered a stroke we would be in financial difficulty because as we have so much leveraged/investment debt.

My view has always been to ‘live on the edge or you are taking up too much room ‘. What I should have done was to have enough critical care insurance to cover a major event such as a cancer diagnosis or heart attack, stroke, etc. Just like many of my clients I restricted the amount of cover I had because even though 1 in 3 of us will get cancer before we turn 65 I knew I wasn’t going to be one of them.

When my clients are paying for premiums they sometimes complain its too much, “I don’t need this insurance”, “I ‘m healthy” etc. When you are on the other side I have never heard anyone say that they had too much insurance.

By the way, 1,500 women are diagnosed with breast cancer every year in New Zealand. We have the second highest rate of breast cancer in the world. The USA comes in tops at 1 in 8 women getting breast cancer and NZ comes second with 1 in 10 women getting it. In 2006, 600 women died in New Zealand died from breast cancer.

The reason I might be lucky is that I might be able to continue to work during chemo so our income won’t drop too drastically – we hope. A stroke would have been different because I would be unable to work and it would therefore be impossible to get the finance to pay for a property which is due to be paid for in March. The trauma insurance that I have will go towards significantly reducing our personal mortgage – albeit momentarily – because we were planning extensions to the house. I think diamonds would look nice on my ears so there might be a little insurance left over to get some. All the money shouldn’t go to serious stuff like debt reduction.

What else might I do with the money? If I am HER 2-neu positive I could use my trauma insurance pay-out to pay for Herceptin (not funded by the Government). This drug has been shown to reduce the risk of cancer returning by 30%. Humph! I would prefer to pay off the mortgage and have the diamonds but at least I have the insurance money available if I need to take the drug. This is why we took out trauma insurance. To cover expenses especially debt, and to provide options such as drugs and treatments not available via our public health system. Several years ago a client went to San Francisco for treatment for his prostate cancer. This treatment is now available in New Zealand but it wasn’t at the time our client found he had cancer.

Some women mortgage their homes or go to their families to ask for funding for Herceptin that can cost $120,000 or more for a one year course. This cost is for a 70kg woman. It costs more based on weight – and if the cost is the same proportion it would cost me $180,000. Fortunately you only have a one year cycle of it.

{The New Zealand Government via Pharmac now fund Herceptin}

If I had my medical insurance with ING then they would pay for this medication. You have $150,000 cover per operation and if the operation only costs $15,000 you can use the difference to buy drugs that are not on the Pharmac list. Click here to request a quote. As it happens I am in a group scheme with Southern Cross. It’s pretty good. My mastectomy cost $10,000 and breast reconstruction will cost around $25,000. I will have to pay for the thigh liposuction.

If women have mastectomies via the public health system they can have breast reconstruction at the same time they have a mastectomy, but if they are like me and defer for a year they will not get it. They will be dumped off the waiting list after two years. New breasts are not a priority within our health system. There are so many other costs. Private medical insurance is very important. Do you have it?

Yes, I know insurance is expensive and this is why I am gentle with people. I don’t want to make you poor and miserable just because of a need to have insurance, but my situation would be so incredibly different if I hadn’t had it. It’s a wonderful peace of mind. I should have taken out more though. It will be a while before an insurance company will look at me now.

Please reconsider how much you are willing to spend per month on insurance. If you are prepared to spend more I can arrange more cover for you.

Would you like a quote for more critical care insurance?” Click here to request a quote or review

Here’s how my insurance cover helped me:

Medical Insurance:

Cancer is considered serious so I could have gone into the Public Health system, but with the timing of the year – Christmas and New Year holidays – I would have had to wait until mid January for an operation. Imagine the stress to know you have cancer but may have to wait 4-5 weeks before an operation! I preferred the peace-of-mind of going privately and having it out as soon as possible with a specialist rather than a registrar.

Actually a District Nurse said I could have had an operation at the public hospital. She said a registrar could have performed the operation. This is the point. I wanted and chose to have one of the most highly regarded breast surgeons in New Zealand perform my operation not some registrar yet to prove his or her expertise. It takes many years before you are recognised as being an expert or specialist in any field.

The operation cost $9,600 and the specialist bills just seem to keep coming: surgeon, oncologist.

Trauma Insurance:

One of the first things I did was to check my insurance to see what level of cover I had. It was again great peace of mind to know I would get a lump sum pay-out. Oh how I would have liked it to have been more!

Income Protection Insurance:

I shouldn’t need to make a claim as I expect to be able to work for more than 15 hours per week. It brought home the importance for business owners to have ‘agreed value’ policies not ‘indemnity’ and to review their level of cover every 2-3 years.

Life Insurance and Total & Permanent Disability Insurance:

It gave me great joy to know if I did die there would be a decent pay out for my family.

Click here to request a Trauma Insurance quote or an insurance review